Why India’s Risk and AML Teams Need Agentic AI

In October 2025, UPI processed 20.7 billion transactions worth ₹23.49 lakh crore. That’s not a milestone— it’s a warning. While India’s payments infrastructure races ahead at unprecedented speed, most risk and AML operations still rely on built on manual review, fragmented data & outdated tools.

Over 95% of your alerts are false positives. Your analysts are drowning in noise while genuine threats—rapid mule rotations, real-time micro-layering, synthetic identity networks—slip through undetected.

Global AML-related fines reached $6.6 billion in 2023. RBI and FIU-IND are demanding faster, more accurate SAR/STR submissions. And every day you delay modernization, the gap between criminal sophistication and your detection capabilities widens.

This isn’t about replacing your controls. Your existing systems are the foundation. Agentic AI is the force multiplier that makes them effective at the speed India’s instant payments demand.

From Reactive Tools to Intelligent Partners

Traditional compliance technology follows a simple pattern: ingest data, apply rules, generate alerts, wait for humans. This worked when transaction volumes were manageable and criminals moved slowly. Neither condition exists today.

Agentic AI represents a fundamental architectural shift. These aren’t chatbots with compliance training. They’re autonomous investigative systems that reason across datasets, pursue leads, build evidence chains, and generate prosecution-ready documentation—all while maintaining the transparency and human oversight that regulators require.

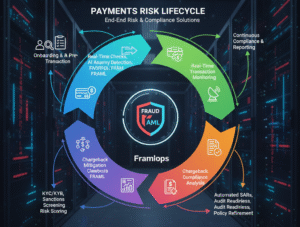

The evolution happens in two phases, and understanding this progression is critical for strategic planning:

- Copilot Agents act as intelligent assistants. They summarise alerts, enrich context, surface hidden patterns, and answer investigator queries in plain language—reducing workload while improving speed.

- Autonomous Agents go a step further. Within clear governance rules, they triage alerts, map entity relationships, execute SAR workflows, and learn from analyst feedback—improving precision and reducing noise.

Both modes operate within strict governance boundaries. The difference is operational leverage: copilots multiply analyst productivity; autonomous agents transform what’s humanly possible to accomplish.

Six Transformations That Define the Agentic Advantage

These aren't incremental improvements. They're structural changes to how compliance operations function.

1. Stop Alert Overload: Get Clear Signals Instead

HSBC’s deployment of AI-driven transaction monitoring achieved over 60% reduction in false positives. Other institutions report up to 70% reduction in name screening noise. These aren’t marketing claims—they’re audited outcomes. When your analysts spend time on genuine risks instead of chasing phantoms, detection rates improve and burnout decreases.

2. Analysis From Manual Tedious Work to Strategic Analysis

Evidence gathering. Case documentation. STR/SAR narrative drafting. These tasks consume 60-70% of analyst time in traditional operations. Agentic systems handle them autonomously—not by cutting corners, but by processing information faster and more consistently than humans can. Your experienced investigators return to actual investigation.

3. From Static Rules to Adaptive Intelligence

New money mule network pattern identified. New RBI circular issued. New crypto-layering technique emerging. Traditional systems require weeks of rule development and testing. Agentic systems adapt in days—learning from analyst feedback, regulatory updates, and emerging typologies without operational disruption.

4. From Black Box to Transparent Reasoning

Every decision path documented. Every data source cited. Every escalation rationale preserved. This isn’t just good practice—it’s regulatory necessity. RBI’s responsible AI framework demands explainability. FIU-IND expects defensible filing decisions. Agentic systems are architected for auditability from the ground up.

5. From Siloed Detection to Unified Intelligence

Fraud sees transaction anomalies. AML sees structuring patterns. KYB sees corporate ownership complexity. In traditional architectures, these insights exist in separate systems, reviewed by separate teams, with separate blind spots. Agentic AI bridges these domains—the same suspicious pattern that triggers a fraud flag automatically enriches the AML investigation and informs sanctions screening.

6. From Reactive Detection to Proactive Prevention

The fundamental shift: identifying risk indicators during onboarding, during initial transaction patterns, before losses materialize or regulatory issues develop. Prevention economics are dramatically better than detection economics—and agentic systems make prevention operationally feasible at scale.

The Strategic Imperative

The institutions deploying agentic AI today aren’t just improving operations—they’re building durable competitive advantages. Faster investigations. Lower unit costs. Better regulatory relationships. More resilient growth trajectories.

Meanwhile, the gap widens. Criminals continue to leverage AI for attack. Regulators continue to raise expectations. Transaction volumes continue to accelerate. The cost of inaction compounds daily.

The question isn't whether agentic AI will transform financial crime prevention in India. It's whether your institution will lead the transformation—or spend the next decade catching up.