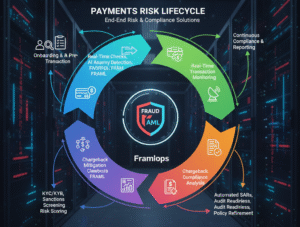

Building a high-performance FRAML (Fraud + Anti-Money Laundering) operation is the new gold standard for fintechs and payment providers. In a world where real-time payments are the norm, traditional “siloed” departments—where one team looks for stolen credit cards (Fraud) and another looks for suspicious wealth patterns (AML)—are becoming obsolete.

Since criminals don’t distinguish between fraud and laundering, your defense shouldn’t either. Here is a breakdown of how to build and optimize these operations.

1. The Strategy: What is FRAML?

FRAML is the convergence of Anti-Money Laundering (AML) and Fraud prevention into a single, unified framework.

- Traditional Silos: Fraud teams focus on “speed” (blocking a transaction in milliseconds), while AML teams focus on “patterns” (reporting suspicious behavior over months).

- The FRAML Advantage: By merging these, you use the same data to stop the theft and identify the criminal network behind it simultaneously.

2. Key Pillars of High-Performance FRAML

A. Unified Data Architecture

High performance starts with a “Single Source of Truth.” Instead of having separate databases for KYC (Know Your Customer), transaction history, and device fingerprints, a FRAML operation feeds all this into one engine.

- Real-Time Ingestion: Systems must process data at 50+ transactions per second (TPS) with sub-second latency to prevent fraud without slowing down legitimate payments.

- Identity Intelligence: Linking device IDs, IP addresses, and behavioral biometrics with traditional banking data to spot “mule” accounts.

B. Hybrid AI & Machine Learning

Rules-based systems (e.g., “Flag if > $10,000”) are too easy for criminals to bypass.

- Behavioral Baselining: Use AI to learn a “normal” day for a specific user. Anything outside that profile triggers an alert.

- Explainable AI (XAI): For fintechs, regulators require you to explain why an AI flagged a user. High-performance tools now provide “human-readable” reasons for AI decisions to simplify audits.

C. Collaborative Case Management

Instead of two different software platforms, analysts use one dashboard.

- Cross-Training: Analysts are trained to look for “blended threats”—for example, a series of small “friendly fraud” chargebacks that actually indicate a professional laundering operation.

- Automated SARs: High-performance operations use automation to pre-fill Suspicious Activity Reports (SARs), reducing the time spent on paperwork by up to 80%.

3. Operational Benefits for Fintechs

| Feature | Legacy Operations | High-Performance FRAML |

| Detection | Reactive (after the loss) | Proactive (preventative) |

| False Positives | High (frustrates customers) | Low (AI-filtered noise) |

| Cost | Doubled (two teams/tools) | Optimized (shared resources) |

| Regulatory Risk | High (blind spots) | Low (unified audit trail) |

4. Implementation Checklist

If you are building this for a payment provider, follow these steps:

- Audit Your Stack: Identify where fraud and AML data overlap (it’s usually 70-80% the same data).

- API Integration: Use a “Headless” risk engine that can plug into your existing checkout or banking app via API.

- Define Shared KPIs: Instead of just “fraud loss %,” track “alert yield” and “time to resolve” across both departments.

- Regulatory Sandbox: Test your new FRAML rules against historical data to ensure you aren’t accidentally blocking legitimate customers.