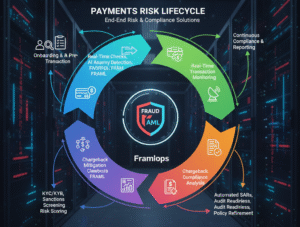

In 2025, risk and compliance teams face a convergence of AI-powered fraud and outdated operations. Discover why AI-native risk intelligence is essential for building resilience, accelerating decisions, and ensuring regulatory readiness.

The New Reality of Risk Operations

As 2025 winds down, risk, fraud, and compliance teams are under more pressure than ever.

Fraudsters now use AI-generated deepfakes, synthetic identities, and real-time social engineering to target businesses at scale. Meanwhile, internal friction — from data silos to manual reviews — keeps teams reactive instead of predictive.

The result: rising fraud losses, stricter regulations, and exhausted analysts trying to compensate with outdated tools.

It’s clear — traditional risk operations are no match for AI-age threats.

What’s Broken in Risk Operations

Across the industry, several core weaknesses continue to surface:

- Siloed Data Ecosystems

Risk and compliance teams still operate on disconnected data islands, limiting visibility and collaboration. - Heavy Dependence on IT and Data Science

Every workflow update or rule adjustment depends on engineering—creating delays exactly when threats evolve fastest. - Fragmented Tool Stacks

Multiple point solutions mean duplicated data, context gaps, and inconsistent decisioning. - Manual Workflows and Oversight Gaps

Human-intensive reviews slow down processes and increase error rates. - Static, Top-Down Policies

Fixed rules and rigid governance models fail to adapt to emerging fraud patterns.

These issues don’t just create inefficiency — they expose companies to preventable risk and compliance shortfalls.

The Path Forward: AI-Native Risk Intelligence

Modern organizations are shifting from fragmented workflows to unified, adaptive risk systems powered by AI.

Here’s what defines this next-gen approach:

- Unified Data Architecture – Shared schemas across risk, fraud, and compliance teams for holistic insights.

- Low-Code/No-Code Orchestration – Analysts can configure and deploy rules rapidly, without IT bottlenecks.

- Integrated Decisioning + Case Management – A single system connects the entire user journey from onboarding to transaction monitoring.

- Automation + ML-Driven Audits – Reduces manual work while ensuring traceability and audit readiness.

- Dynamic Learning Frameworks – Constantly updated models that evolve as fraud tactics shift.

This isn’t just a technological upgrade — it’s an organizational transformation toward real-time, intelligence-led risk management.

Outcomes That Redefine Modern Risk Ops

Implementing AI-native risk intelligence delivers measurable business impact:

- Complete Visibility: Unified risk data for faster, better decisions.

- Operational Efficiency: 50–70% faster investigations via automated triage and enrichment.

- Compliance Confidence: Built-in governance and transparent audit trails.

- Cost Optimization: Reduced IT dependency and lower manual workload.

- Adaptive Resilience: Policies that evolve instantly with new fraud vectors.

The Future Is AI-Native

2025 marks a turning point — risk teams can no longer rely on static systems to fight adaptive threats.

AI-native risk intelligence is not optional; it’s foundational to building resilient, compliant, and scalable organizations. Those who make the shift now will lead the next generation of fraud prevention and trust infrastructure.

So, where does your organization stand?

Are your tools learning as fast as the threats you face — or just reacting after the damage is done?