The list of companies you provided represents the backbone of the global digital economy—spanning global banking (HSBC), e-commerce giants (Amazon, Noon), and fintech leaders (Razorpay, PhonePe).

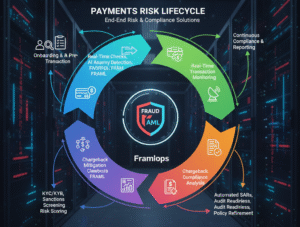

At Framlops, our leadership team brings direct, “on-the-ground” experience from these industry titans. We don’t just understand FRAML (Fraud + Anti-Money Laundering) theoretically; we have built and scaled these operations for companies that process billions of transactions.

Our Leadership DNA

Our expertise is forged in the high-stakes environments of the world’s most successful tech and finance firms:

- Global Scale (Amazon & Noon): Experience managing fraud at the scale of millions of daily shipments and digital payments across different continents and regulatory zones.

- Banking Rigor (HSBC): Deep understanding of institutional compliance, AML governance, and the stringent security standards required by global regulators.

- Fintech Innovation (Razorpay & PhonePe): Mastery of real-time payment security, UPI ecosystems, and high-velocity risk engines that protect both merchants and consumers.

- Specialized Risk (mFilterit, ChargebackGurus, & ChargebackZero): Direct leadership in the niche sectors of ad-fraud prevention, chargeback automation, and dispute management.

What This Means for Your Business

When you partner with a team that has led operations at these organizations, you gain a competitive edge:

- Tested Frameworks: We apply the same high-performance methodologies used by Amazon and PhonePe to your specific risk profile.

- Regulatory Confidence: Our experience with HSBC ensures that your FRAML strategy isn’t just fast—it’s audit-ready and compliant with global standards.

- Revenue Recovery: Drawing from our background at ChargebackGurus and ChargebackZero, we focus on minimizing “false positives” so you never block a legitimate sale.

- Agile Tech Integration: We help you move away from legacy silos and toward the unified AI-driven engines used by modern fintech leaders like Razorpay.