The Crack in the System

Ever received a fraud alert for a sudden UPI spike—only for the AML team to notice layering weeks later?

That delay is the weak link that criminals exploit every day.

FRAML (Fraud + AML) brings both functions together, closing those gaps and connecting the dots across the entire financial crime chain.

Because when teams work separately, crooks play the full match while we watch fragments of the replay.

How the Play Unfolds

Victim scam → Bank A mule → Cross-border gateway → Bank B mule → Crypto (USDT/Binance) or transnational accounts → Dubai drugs/terror cells.

Same dirty money. Different lenses.

Fraud teams see only the payment spikes. AML sees the layering—weeks later. By then, the trail’s gone cold.

Result? Fragmented insights. Missed connections. Criminals cashing out freely. 😤

The Silo Pain Every Risk & AML Team Knows

Fraud team:

“Monday UPI burst—new account, high volume, no complaint. Case closed.” ✅

AML team (a week later):

“Same account linked to cross-border layering. SAR/STR filed. Fraud data? Not linked.” 📊

Each team logs a “win.”

The network logs millions.

Mules emerge daily. The same scam pattern repeats hundreds of times:

Scam → UPI → Mule 1 → Mule 2 → Gateway → Crypto → Gone.

Without unified visibility, each team fights half the battle.

Lessons From the Field

When I managed risk and AML teams at banks and fintechs, we dealt with thousands of alerts weekly. Fraud cases in one queue, AML cases in another.

Then I tried something simple—cross-checking cases.

What showed up was eye-opening:

- Matching IPs, devices, payment instruments, and emails across both streams.

- Isolated signals turned into clusters.

- Unified clusters met FIU filing thresholds, which individual alerts had missed.

That’s when it became clear: FRAML isn’t a buzzword—it’s an operational necessity.

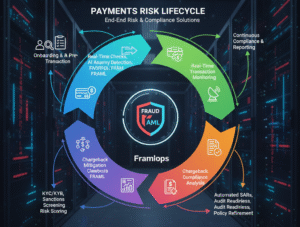

The FRAML Advantage: 10x Investigator Power ✅ Joint Training: Fraud + AML teams trained together on shared typologies and signals.

✅ Unified Data Fabric: Shared enrichment builds a 360° view of entities and transactions.

✅ Risk Graph Intelligence: Connect KYC, transactions, alerts, and devices through graph analytics—revealing hidden mule networks.

✅ Agentic AI: Automates triage and helps analysts investigate 3x faster, with explainable outputs.

✅ Reg-Ready Reporting: Structured, auditable workflows aligned with RBI, FIU, and FinCEN standards.

The combination of human judgment + AI-powered intelligence drives fewer false positives, faster closures, and full compliance confidence.

A Simple Test for 2026

Take one confirmed fraud alert from last week.

Now, match it against your AML cases filed to FIU India.

What hidden connections appear?

That one cross-check could expose entire laundering loops your systems missed.

If you’d like to see how unified FRAML workflows can connect these dots intelligently through shared data and automation, let’s talk.

Final Thoughts

2026 is the year risk and compliance need to break silos once and for all.

FRAML turns fragmented responses into a unified intelligence engine—one that outthinks and outpaces financial crime.

Let’s make 2026 the year we finally crush silos and take fraud and AML from reactive firefighting to predictive precision. 💪🎯